Check your insurance plan’s formulary. Many plans cover Viagra, but coverage varies significantly depending on your specific policy and the pharmacy you use. Look for the drug’s name (sildenafil citrate) or brand name (Viagra) within your plan’s list of covered medications. This simple step saves you time and potential unexpected costs.

Next, contact your insurance provider directly. Their customer service representatives can provide precise details about your copay, deductible, and any prior authorization requirements. This information will give you an accurate estimate of your out-of-pocket expense. Don’t hesitate to ask questions; clarifying details upfront prevents future surprises.

Consider generic alternatives. Sildenafil citrate, the generic version of Viagra, is usually far more affordable. Your doctor can easily prescribe this less expensive option, potentially saving you a substantial amount of money without compromising efficacy. This is often a simple and effective way to reduce costs.

Explore pharmacy coupons and discount programs. Many pharmacies offer discount cards or programs that can reduce your costs, regardless of your insurance coverage. Websites like GoodRx can help you find potential savings. Comparing prices across different pharmacies can also lead to substantial cost savings.

- Viagra Insurance Cost: A Comprehensive Guide

- Does Medicare Cover Viagra?

- Medicare Part D and Viagra

- Exploring Other Options

- Talking to Your Doctor

- Viagra Coverage Under Private Insurance Plans

- Factors Affecting Viagra’s Out-of-Pocket Cost

- Your Insurance Plan

- Prescription Details

- Other Factors

- Recommendation:

- Generic Viagra: Cost Savings Opportunities

- Comparing Prices: Strategies for Lower Costs

- Negotiating Prescription Drug Prices with Your Pharmacy

- Explore Pharmacy Discount Programs

- Inquire About Prescription Drug Savings Cards

- Negotiate Payment Plans

- Consider Mail-Order Pharmacies

- Exploring Patient Assistance Programs for Viagra

- Comparing Costs Across Different Pharmacies

- Generic vs. Brand-Name Viagra

- Mail-Order Pharmacies

- Negotiating Prices

- Using Online Pharmacy Comparators

- Understanding Viagra’s Cost vs. Its Health Benefits

- Weighing the Costs

- Exploring Alternatives

Viagra Insurance Cost: A Comprehensive Guide

Check your insurance plan’s formulary. This list details covered medications and their cost-sharing levels (copay, coinsurance). Viagra, or its generic equivalent sildenafil, may be covered under your plan’s prescription drug benefit, but coverage varies widely.

Consider a generic alternative. Sildenafil, the generic version of Viagra, is significantly cheaper. Your doctor can easily prescribe this.

- Savings: Generics often reduce your out-of-pocket expenses substantially.

- Effectiveness: Sildenafil is chemically identical to Viagra and equally effective for most men.

Explore manufacturer savings programs. Pharmaceutical companies frequently offer coupons and assistance programs to lower medication costs. These programs are often available directly through their websites.

Negotiate your price with your pharmacist. Pharmacists have some flexibility in pricing, especially for cash-paying customers. Politely inquire about potential discounts or programs they offer.

- Ask about discounts: Many pharmacies offer discounts for multiple-month prescriptions.

- Explore patient assistance programs: These programs provide free or discounted medications for patients with limited income.

Use a prescription discount card. Independent companies offer discount cards that may lower your medication’s cost, even if it’s not covered by insurance. Compare several cards before choosing one.

Compare insurance plans. If you aren’t satisfied with your current coverage, shop around during open enrollment periods. Pay close attention to prescription drug benefits offered by different plans.

- Consider the formulary: A plan with Viagra or sildenafil on a lower tier will usually result in lower costs.

- Check the copay: The copay is the fixed amount you pay for each prescription fill.

Always consult your doctor. Discuss cost-effective treatment options with your physician before making any changes to your medication regimen.

Does Medicare Cover Viagra?

Generally, no. Medicare Part A (hospital insurance) and Part B (medical insurance) don’t typically cover Viagra or other erectile dysfunction (ED) medications. This is because Medicare primarily covers medically necessary treatments, and ED drugs are usually considered to address a condition that isn’t life-threatening.

Medicare Part D and Viagra

Medicare Part D, the prescription drug plan, might offer some coverage, but it depends heavily on your specific plan. Many Part D plans have restrictions on coverage for ED medications, often requiring prior authorization or placing them in higher cost tiers. Check your plan’s formulary – a list of covered drugs – to see if Viagra is covered and what the cost-sharing will be.

Exploring Other Options

If Viagra’s cost is a concern, explore these avenues:

| Option | Description |

|---|---|

| Medicare Savings Programs | These state-run programs help low-income seniors pay their Medicare premiums and sometimes out-of-pocket costs. Eligibility depends on income and resources. |

| Manufacturer Coupons and Discounts | Pharmaceutical companies often offer coupons or patient assistance programs to lower medication costs. Check the Viagra manufacturer’s website. |

| Generic Alternatives | Sildenafil, the generic version of Viagra, is often significantly cheaper. Discuss alternatives with your doctor. |

Talking to Your Doctor

Openly discuss your financial constraints with your physician. They can help you find affordable treatment options for ED, whether that’s exploring generic alternatives or other approaches to managing the condition.

Viagra Coverage Under Private Insurance Plans

Check your policy details. Coverage varies significantly between insurers and plans. Some plans fully cover Viagra, others partially cover it, and many don’t cover it at all. Your specific benefits depend on your plan’s formulary, which lists covered medications and their cost-sharing requirements.

Contact your insurer directly. They possess the most accurate, up-to-date information regarding your plan’s coverage. Ask about specific requirements and any pre-authorization processes needed.

Consider alternative medications. If Viagra isn’t covered, your doctor might suggest similar medications that your plan covers. These alternatives might have different cost-sharing structures.

Explore manufacturer coupons and patient assistance programs. Pharmaceutical companies frequently offer programs to reduce out-of-pocket expenses. These programs can help significantly lower the cost, regardless of insurance coverage.

Negotiate with your pharmacy. Pharmacies sometimes offer discounts or payment plans. Inquire about these options if your co-pay remains high.

Review your prescription drug benefits. Your Summary of Benefits and Coverage (SBC) details your plan’s coverage. This document clearly outlines what drugs are covered and at what cost.

Factors Affecting Viagra’s Out-of-Pocket Cost

Your out-of-pocket Viagra cost depends heavily on several key factors. Understanding these will help you budget accordingly.

Your Insurance Plan

- Formulary Coverage: Check if Viagra (sildenafil) or its brand-name equivalent is included in your health plan’s formulary. Generic sildenafil is often cheaper than branded Viagra.

- Tier Level: Your plan likely categorizes medications into tiers, affecting your copay. Higher tiers mean higher costs. A higher tier for Viagra means a higher out-of-pocket expense.

- Deductible: Before your insurance covers any medication, you must usually meet your annual deductible. Once met, your copay applies.

- Copay/Coinsurance: Your copay is a fixed amount you pay per prescription. Coinsurance is a percentage of the cost you pay after meeting your deductible.

Prescription Details

- Dosage: Higher dosages generally cost more per pill.

- Quantity: The number of pills per prescription influences the total cost.

- Pharmacy: Prices vary between pharmacies. Comparing prices beforehand can save you money.

Other Factors

- Generic vs. Brand-Name: Generic sildenafil is significantly cheaper than Viagra.

- Manufacturer Coupons: Pharmaceutical companies occasionally offer manufacturer coupons reducing your cost at the pharmacy.

- Patient Assistance Programs: Explore if you’re eligible for patient assistance programs offered by the manufacturer or other organizations. These programs often provide discounted or free medications.

Recommendation:

Contact your insurance provider to clarify your coverage for Viagra or generic sildenafil. Compare prices from different pharmacies. Consider a lower dosage if appropriate. Inquire about manufacturer coupons and patient assistance programs.

Generic Viagra: Cost Savings Opportunities

Consider generic sildenafil, the active ingredient in Viagra. This significantly reduces your out-of-pocket expenses. Expect to pay 50-80% less than brand-name Viagra.

Comparing Prices: Strategies for Lower Costs

Shop around! Different pharmacies offer varying prices. Online pharmacies often provide competitive rates, but ensure they’re reputable and licensed. Check for coupons and discounts; many manufacturers and pharmacies offer savings programs. Explore your insurance coverage; while Viagra may be expensive, generic sildenafil often has better coverage, significantly lowering your costs.

Consider a 90-day supply. Purchasing larger quantities frequently results in a lower per-pill price. Discuss long-term prescription options with your doctor. This can streamline the process and potentially save you time and money.

Negotiating Prescription Drug Prices with Your Pharmacy

Ask about generic alternatives. Generic medications often cost significantly less than brand-name drugs, and are usually just as effective. Your doctor might have already prescribed a generic, but it’s always worth double-checking. Many pharmacies also offer their own generic brands, which can be cheaper than name-brand generics.

Explore Pharmacy Discount Programs

Many pharmacies have their own discount programs or partner with organizations offering savings on prescription drugs. Check your pharmacy’s website or ask a pharmacist about these options. Consider programs like GoodRx or Blink Health, which provide online price comparisons and discounts. Some programs require a membership fee, so carefully compare the potential savings against the cost of membership.

Inquire About Prescription Drug Savings Cards

Manufacturer coupons and savings cards can reduce your out-of-pocket costs. These are often available directly from drug manufacturers’ websites or through your doctor. Remember to ask your pharmacist if they accept these cards at the time of purchase.

Negotiate Payment Plans

If the cost of your medication presents a significant financial burden, discuss payment plan options with your pharmacist. Many pharmacies offer flexible payment arrangements to help patients manage their expenses. Be upfront about your financial situation; pharmacists are often willing to work with patients.

Consider Mail-Order Pharmacies

For regularly prescribed medications, mail-order pharmacies often offer lower prices due to their higher purchasing volume. Compare the costs with your local pharmacy before making a decision. Factor in shipping time and any potential convenience costs.

Exploring Patient Assistance Programs for Viagra

Check manufacturer Pfizer’s patient assistance program first. Their program, called Pfizer RxPathways, may significantly reduce or eliminate your Viagra costs. Eligibility requirements vary; income level is a key factor. Apply directly through their website.

Consider programs offered by independent pharmaceutical patient assistance foundations. Many organizations specialize in helping individuals access medications they can’t afford. The Patient Advocate Foundation and NeedyMeds are good starting points. These resources offer searchable databases of programs covering various prescription drugs, including Viagra.

Explore your insurance provider’s options. While Viagra isn’t always covered by basic plans, many insurance companies have programs to help with high-cost medications. Review your policy details and contact your insurer directly for available assistance. They may offer co-pay assistance or other cost-saving options.

Research local or state programs. Some state governments and local health organizations provide prescription drug assistance for low-income residents. These programs often have specific requirements and limited funding, so early application is advised.

Negotiate with your pharmacy. Pharmacies sometimes have their own discount programs or can work with manufacturers to get you a lower price. Don’t hesitate to ask them about available options.

Remember: Eligibility criteria differ among programs. Be prepared to provide income documentation and other personal information. Thoroughly investigate each program to see if you qualify.

Comparing Costs Across Different Pharmacies

Check prices at major pharmacy chains like CVS, Walgreens, and Walmart. Their online price checkers offer quick comparisons. Consider using a prescription discount card; these often provide significant savings, sometimes exceeding 80% off the original price. Many insurance plans negotiate lower rates with specific pharmacies, so verify your plan’s preferred providers.

Generic vs. Brand-Name Viagra

Generic sildenafil (the active ingredient in Viagra) is considerably cheaper. Expect to pay significantly less for the generic version. The difference can be substantial, often hundreds of dollars annually. Check your insurance coverage for both brand-name and generic options to make an informed decision.

Mail-Order Pharmacies

Mail-order pharmacies frequently offer competitive pricing, particularly for those taking Viagra regularly. They often provide discounts for 90-day supplies. However, factor in shipping time when comparing prices. Remember to confirm their legitimacy and safety protocols before using a mail-order pharmacy.

Negotiating Prices

Don’t hesitate to call your local pharmacies and ask about their pricing and any available discounts. Some pharmacists may be willing to negotiate, especially for regular prescriptions. This is particularly true for larger orders or longer-term commitments.

Using Online Pharmacy Comparators

Several websites specialize in comparing prescription drug prices across various pharmacies. These tools can save you time and effort in finding the best deal. Use these sites responsibly, checking the website’s reputation and security measures before submitting any personal information.

Understanding Viagra’s Cost vs. Its Health Benefits

Viagra’s price varies significantly based on your insurance coverage, pharmacy, and dosage. Generic sildenafil, the active ingredient in Viagra, is considerably cheaper. Expect to pay anywhere from $20 to $80 per pill for brand-name Viagra without insurance; generics often cost under $20. Many insurance plans partially cover Viagra, especially if erectile dysfunction (ED) is medically diagnosed as impacting overall health. Check with your provider to determine your out-of-pocket expenses. Consider using a prescription discount card for potential savings.

Weighing the Costs

The cost of Viagra should be considered alongside its potential health benefits. For many men, improved sexual function leads to enhanced intimacy and improved relationships. However, Viagra isn’t a solution for all ED causes. Underlying health conditions like heart disease, diabetes, or high blood pressure require addressing before considering ED medication. Side effects, while uncommon for many, should be discussed with a physician. These may include headaches, flushing, and nasal congestion. Rare but serious side effects warrant immediate medical attention.

Exploring Alternatives

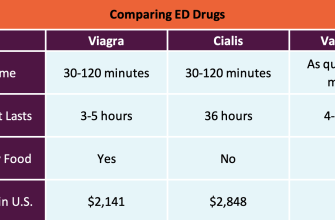

Lifestyle changes like exercise, diet improvement, and stress reduction can help manage ED in some cases. These often represent significantly lower cost options. If Viagra is too expensive or unsuitable, your doctor can explore alternative treatments, such as other ED medications (like Cialis or Levitra), penile injections, vacuum pumps, or penile implants. These treatments have differing costs and efficacy. A frank discussion with your doctor ensures you select the best treatment strategy for your individual circumstances.